Covered Services

Learn more about what we cover -including health, dental, and pharmacy.

Urgent care is care you need for a non-emergency illness or injury. You need urgent care treatment within 24 hours, and you shouldn't have to travel more than 30 minutes for the care. You typically need urgent care to treat a condition that:

- Doesn’t threaten life, limb or eyesight.

- Needs attention before it becomes a serious risk to health.

Examples may include things like a high fever or sprained ankle.

Nurse Advice Line

When using the directory, type in your ZIP code and under Specialty select Urgent Care Center or Convenient Care Clinic. Approval Requirements. TRICARE Prime plans. TRICARE Prime beneficiaries, except for active duty service members (ADSMs) enrolled in TRICARE Prime, do not need a referral for urgent care and Point of Service will not apply.

- Note: When enrolled in TRICARE Reserve Select (TRS), TRICARE Retired Reserve (TRR), TRICARE Young Adult (TYA), or the Continued Health Care Benefit Program (CHCBP), Group A beneficiaries follow Group B deductibles and applicable copayments or cost-shares. TRICARE PRIME® (JAN. 31, 2021) Includes TRICARE Prime, TRICARE Prime Remote, the US.

- Testing copayment waiver: Retroactive to March 18, 2020, TRICARE will waive copayments/cost-shares for medically necessary COVID-19 diagnostic and antibody testing and related services, and office visits, urgent care or emergency room visits during which tests are ordered or administered.

- Care that does not threaten life, limb or eyesight, but needs attention to prevent it from becoming a serious risk to health is known as urgent care. Visit our urgent care page to learn more. Note: Care for accidental injury to the teeth alone or emergency room visits for dental pain are not covered by the TRICARE medical benefit.

- Copayments and cost-shares are subject to change at the beginning of each calendar year. Copayments are per occurrence or per visit. Cost-shares are a percentage of the contracted rate for network providers and the maximum TRICARE allowable for non-network providers on certain types of services.

If it's after hours or you're not sure if you need to see a doctor, call TRICARE's Nurse Advice Line 24/7. Call 1-800-TRICARE (874-2273) — Option 1 to talk to a registered nurse who can:

- Answer your urgent care questions

- Give you health care advice

- Help you find a doctor

- Schedule next-day appointments at military hospitals and clinics

The Nurse Advice Line is available to all TRICARE beneficiaries in the U.S. except those enrolled in the US Family Health Plan. Beneficiaries who live overseas can call the Nurse Advice Line for health care advice when traveling in the U.S., but must coordinate care with their Overseas Regional Call Center.

TRICARE Prime PlansTRICARE Prime plans include: TRICARE Prime, TRICARE Prime Remote, TRICARE Prime Overseas, TRICARE Prime Remote Overseas and TRICARE Young Adult-Prime

If you are a(n)… | To get Urgent Care… |

|---|---|

Active Duty Family Member | You don’t need a referral. |

Retiree or Retiree Family Member | |

Active Duty Service Member Enrolled in TRICARE Prime Remote | |

| Active Duty Service Member Living in a TRICARE Prime Service Area1 | You should seek care at a military hospital or clinic when/where available, or contact the Nurse Advice Line for assistance. |

1If you are a family member or retiree and seek urgent care from a non-network provider outside of a TRICARE authorized urgent care center, you will have to pay point-of-service option cost-shares.

TRICARE Select and All Other TRICARE Plans

If you are a(n)… | To get Urgent Care… |

|---|---|

Active Duty Family Member | You don’t need a referral. |

Retiree or their Family Member |

3You will pay network or non-network copayments or cost-shares, depending on the type of provider you see.

US Family Health Plan

If you are a… | To get Urgent Care… |

|---|---|

US Family Health Plan Member | Visit your designated provider’s web site for details |

Urgent Care Overseas

If you are… | Seeking care… | To get Urgent Care… |

|---|---|---|

Enrolled in TRICARE plan stateside | Overseas while traveling | You don’t need a referral. To ensure your urgent care visit is cashless and claimless, you must get prior authorization from the TRICARE overseas contractor. Otherwise, you may have to pay the provider up front and file a claim for reimbursement later. |

Enrolled in a TRICARE Overseas plan | Overseas | |

Stateside while traveling | You don’t need a referral. |

4If you are enrolled in a TRICARE Prime plan and seek urgent care from a non-network provider outside of a TRICARE authorized urgent care center, you will have to pay point-of-service option cost-shares.

5Active Duty Service Members must follow up with their PCM when they receive care outside of a military hospital or clinic, in accordance with DoD and Service regulations.

This list of covered services is not all inclusive. TRICARE covers services that are medically necessaryTo be medically necessary means it is appropriate, reasonable, and adequate for your condition. and considered proven. There are special rules or limits on certain services, and some services are excluded.

Last Updated 6/18/2020

Find a Doctor

Prescriptions

Vision

Mental Health Therapeutic Services

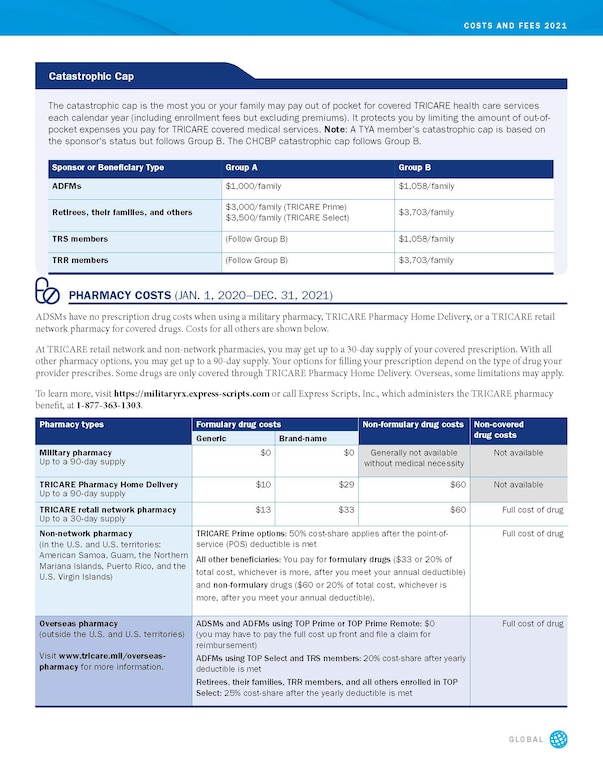

Many costs will be relatively stable in the coming year for military families in Tricare, and pharmacy costs won’t increase, according to new fee information from the Defense Health Agency’s Tricare website.

The notable exceptions are enrollment fees for Tricare Retired Reserve, Tricare Young Adult, and retirees in Tricare Select Group A. As previously reported, monthly enrollment fees are rising sharply for those in Tricare Young Adult, and retirees in Tricare Select Group A must start paying an enrollment fee in 2021.

Active duty families in Tricare Select will see increases of up to a few dollars in the cost-shares they pay for health care for certain services in 2021.

Across the board, pharmacy costs won’t change for all beneficiaries.

Some costs related to non-network inpatient hospitalization care haven’t yet been determined, and are expected to be released in December.

Active duty families in Tricare Prime only pay for care when they get care without a referral, or use non-network providers without authorization, or use a pharmacy other than a military pharmacy. There are no charges to active duty members for any type of health care.

There are differences in some costs for populations based on when the sponsor entered the military. Those who entered before Jan. 1, 2018, are considered Group A. Those who entered on or after Jan. 1, 2018, are considered Group B. It’s based on the Fiscal 2017 National Defense Authorization Act, which implemented Tricare reform. The law required that retirees in Group A start paying the enrollment fee, but delayed it until 2021. This doesn’t apply to those in the Tricare for Life plan.

By law, DoD is required to raise certain beneficiary out-of-pocket cost shares by an amount based on the annual cost of living adjustment, or COLA, for retirees. The COLA is 1.3 percent for 2021.

Sign up for the Early Bird Brief

The Early Bird Brief is a daily roundup of military and defense news stories from around the globe curated by Military Times and Defense News.

Thanks for signing up!

Sign up for the Early Bird Brief - a daily roundup of military and defense news stories from around the globe.

By giving us your email, you are opting in to the Early Bird Brief.

There are about 4.9 million DoD beneficiaries enrolled in Tricare Prime plans, and about 2.1 million enrolled in Tricare Select plans.

Some examples of changes, based on information pulled from the Tricare website’s cost comparison tool, which can also be used for research for the upcoming enrollment open season, from Nov. 9 to Dec. 14:

Enrollment fees: Those in the Tricare Young Adult program will pay $459 per month for Prime, an increase of 22 percent; or $257 for Select, an increase of 12 percent.

• “Gray area” retirees using Tricare Retired Reserve will see enrollment fee increases by about $40 a month for individuals, to $484.83 a month; and by about $99 for families, to $1,165.01 a month. That’s an increase of nearly $1,200 a year for families. There are currently about 3,858 gray area reservist retirees under age 60 with Tricare Retired Reserve plans that cover about 10,400 people. Premiums for Tricare Young Adult, Tricare Retired Reserve and Tricare Reserve Select are set based on analyses of the actual costs in the previous year.

• In addition, the previously reported new Tricare Select fee for retirees in Group A goes from 0 to $150 a year for individuals and $300 for families.

• Of most other Tricare plans with enrollment fees, increases ranged from $3 to $10, depending on the plan. There are no enrollment fees for active duty families in Prime or Select.

Deductibles: These costs stay the same, or increase by amounts ranging from $1 to $8, depending on the plan. There is no deductible for active duty families in Prime.

Catastrophic cap: The catastrophic cap is the most amount of money you pay out of pocket each year for services covered by Tricare, before Tricare will start picking up 100 percent of the cost. It’s increasing for beneficiaries in most Prime and Select programs, except for Tricare for Life, where it remains at $3,000; active duty families in Prime and Select who are in Group A, where it remains at $1,000; and retirees in Tricare Prime, Group A, where it remains at $3,000.

The biggest increase in catastrophic cap is for retirees in Tricare Select, Group A, where it increases from $3,000 to $3,500. That means these retirees will now pay an extra $500 out of pocket before Tricare will start picking up 100 percent of the cost.

Family members of active-duty sponsors who entered the military after Jan. 1, 2018, will see their catastrophic cap increase by $14, from $1,044 to $1,058, whether they are in Prime or Select, as do those in several other Tricare plans.

Tricare Select Urgent Care Copay

Primary care visits: Most costs stay the same, except for retirees in Prime, both Group A and B, with an increase of $1 (to $21) for in-network visits.

Urgent care: Where there are changes, the increases are by $1.

Mental health outpatient/partial hospitalization: Most costs stay the same, except for $1 increases in some plans.

Emergency care: Where there are changes, the increases range from $1 to $7.

Tricare Select Retiree Copays

Pharmacy costs are staying the same through 2021 for all beneficiaries:

• Generic (Tier 1) drugs are at no cost at a military pharmacy; for home delivery they are $10; at a network retail pharmacy they are $13.

• Brand-name (Tier 2) drugs are at no cost at a military pharmacy; for home delivery they are $29; at a network retail pharmacy they are $33.

Again, these are but a few examples; more information is available at the Tricare cost comparison tool.